One of the most common receivables finance techniques is factoring. Factoring is the sale of invoices to a factor (often a bank). This type of financing is suitable for companies that work on deferred payment. Traditional (or classic) factoring is initiated by the supplier, who also accepts recourse. It is used in cases where the initial contract between the supplier and the customer provides a deferred payment. The supplier sells its invoices (“receivables”) to a third party, usually a bank or factoring company, and receives early payment. Classic factoring releases additional working capital, which the supplier can now use to finance further transactions. Besides, the Supplier company reduces the risk of cash gaps due to late payments of customers.

Classic factoring also gives advantages to buyers, who can start working with extended payment terms, increase the reliability of the supply chain and reduce the cost of goods/services. Through the use of factoring, buyers can increase their leverage in procurement and attract new suppliers who have not previously worked on postpaid contracts.

The classic factoring scheme works as follows: the supplier provides goods or services, sells invoices to the Bank (more precisely, assigns the right to claim the debt), where the supplier must first open a current account and provide a complete package of documents. The bank pays to the supplier 80-90% of the invoice amount for the services provided within the invoice payment period. The buyer pays the bank the full amount, and the bank in turn pays the supplier the balance (10-20%). The financing limit and price in this case largely depend on the financial condition of the supplier, while payments are made on the actual receivables. Depending on the bank’s policy, invoices can be approved by the buyer or by the presence of a confirmed certificate of work performed.

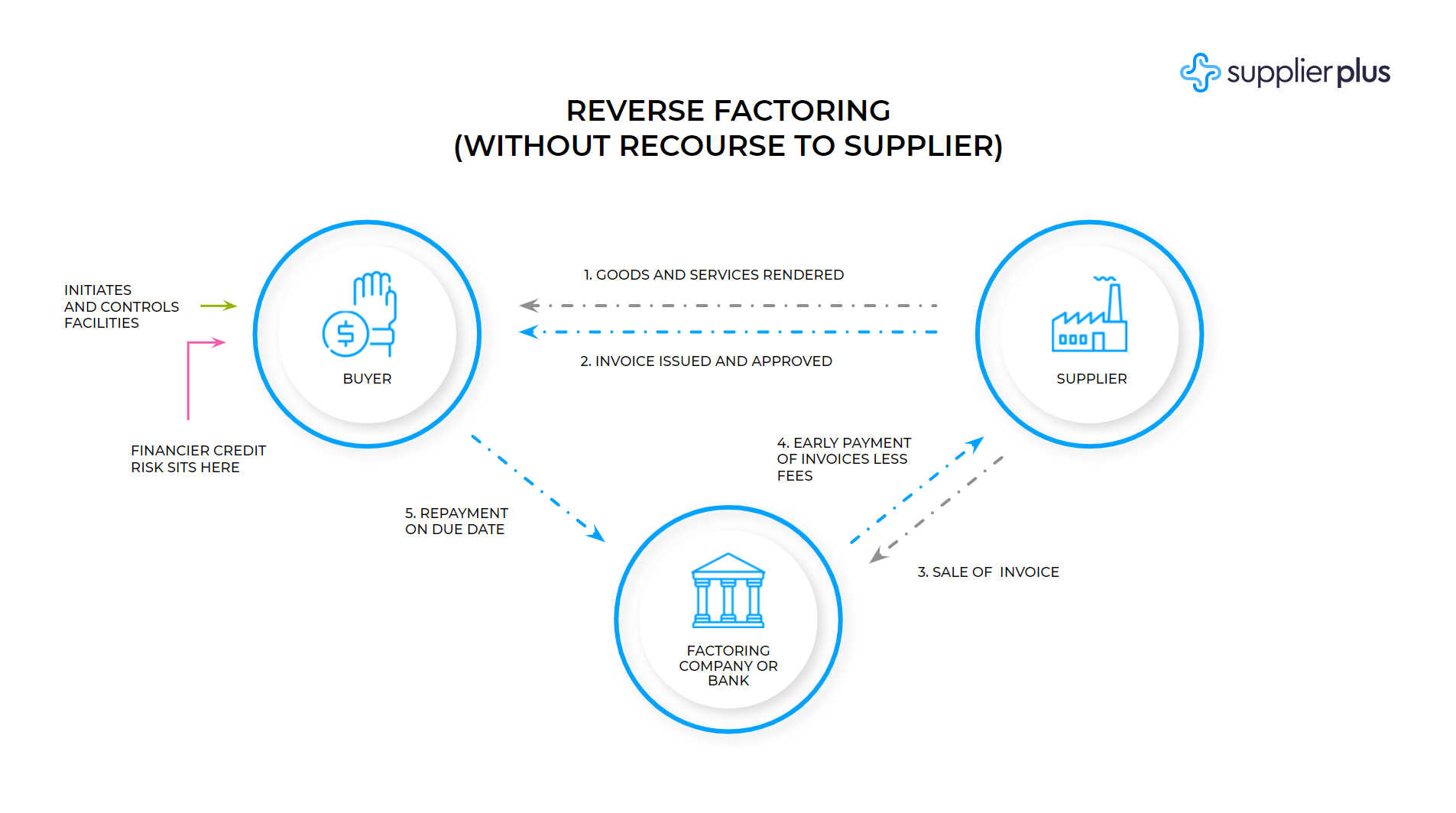

Reverse factoring facilities are initiated by the buyer rather than the supplier. The reverse factoring scheme is similar to the classic one, but before the invoices are sold to the bank, they must be irrevocably approved by the debtor (see diagram 1 below). The credit limit and financing rate are set according to the financial strength of the debtor.

Diagram 1. Reverse factoring workflow

Due to the benefits of reverse factoring programs to both buyers and suppliers, such facilities are growing in popularity globally. Buyers can strengthen their market position and balance sheets, improving supplier pricing and releasing working capital. Suppliers of all sizes and business segments benefit from early payment, speed of payment processing and access to additional working capital, which in turn can help them to overcome economic stress.

So what are the benefits of reverse factoring for suppliers?

- Reverse factoring makes it easier to overcome the effects of economic turbulence. Delay in payments, especially from large buyers, is a pain point of many suppliers, because buyers often seek to lengthen payment terms (especially in times of financial stress). By using reverse factoring, suppliers in any business segment can gain immediate access to liquidity through their receivables, strengthening their position among customers and ensuring stability.

- Reverse factoring reduces suppliers’ financing costs. The interest rate of a reverse factoring facility is largely based on the buyer’s credit profile, so smaller suppliers are able to reduce their financing costs versus SME factoring and other forms of credit.

- Reverse factoring is balance sheet neutral. Taking out a loan increases the liabilities of the borrower, whereas reverse factoring is a true sale of receivables and therefore has no balance sheet impact.