Supplier-led invoice finance solutions

Factoring, invoice discounting, and receivables discounting are some of the typical Supplier-led solutions that help turn unpaid sales invoices into cash.

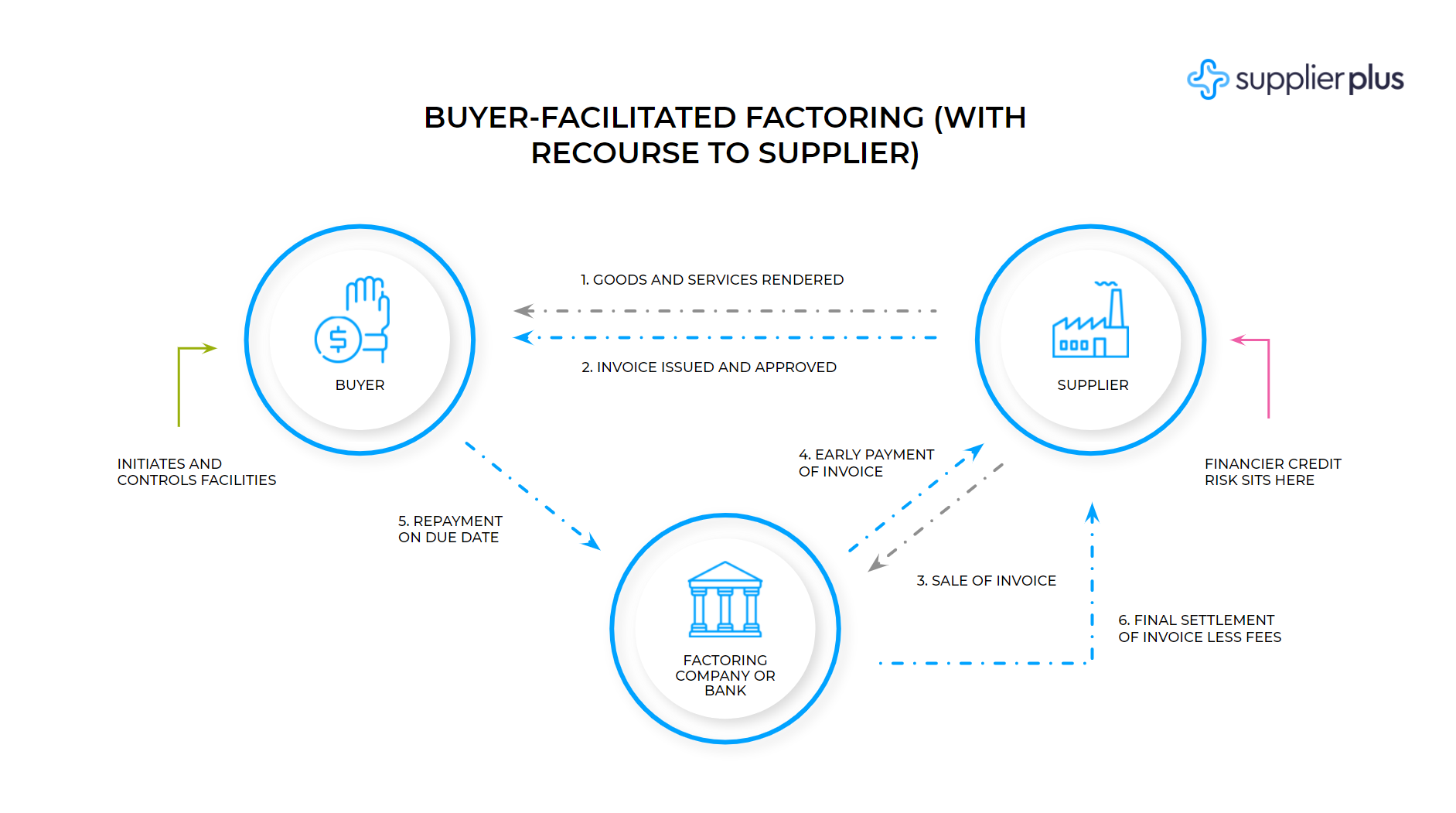

Factoring: a supplier sells its unpaid sales invoices to a financier (a factoring company or bank). The financier makes a partial advance payment to the supplier immediately (usually 80-90% of the invoice amount), while the final payment (remaining 10-20% minus the discount fee) is made when the buyer settles. The financier typically takes responsibility for collections, which mitigates risks for the financier and makes the entire process more efficient. The buyer is expected to confirm debt to the financier for risk mitigation.

In case of payments are significantly delayed or default completely, financiers hold recourse (credit risk) against the supplier. This means that the supplier must be credit-worthy, and therefore not all companies are able to access this kind of funding.

Invoice discounting: a supplier requests an advance payment against an unpaid invoice. The financier makes a full or partial outpayment to the supplier for the invoice period and collects repayment on the expected settlement date. The supplier maintains responsibility for collections and in case of payment defaults, the supplier needs to work out a solution (renew the repayment date or refinance the obligation otherwise). In terms of credit risk, invoice discounting is similar to a revolving credit line against the supplier.

The advantage of invoice discounting is that the buyer need not be involved in the process.

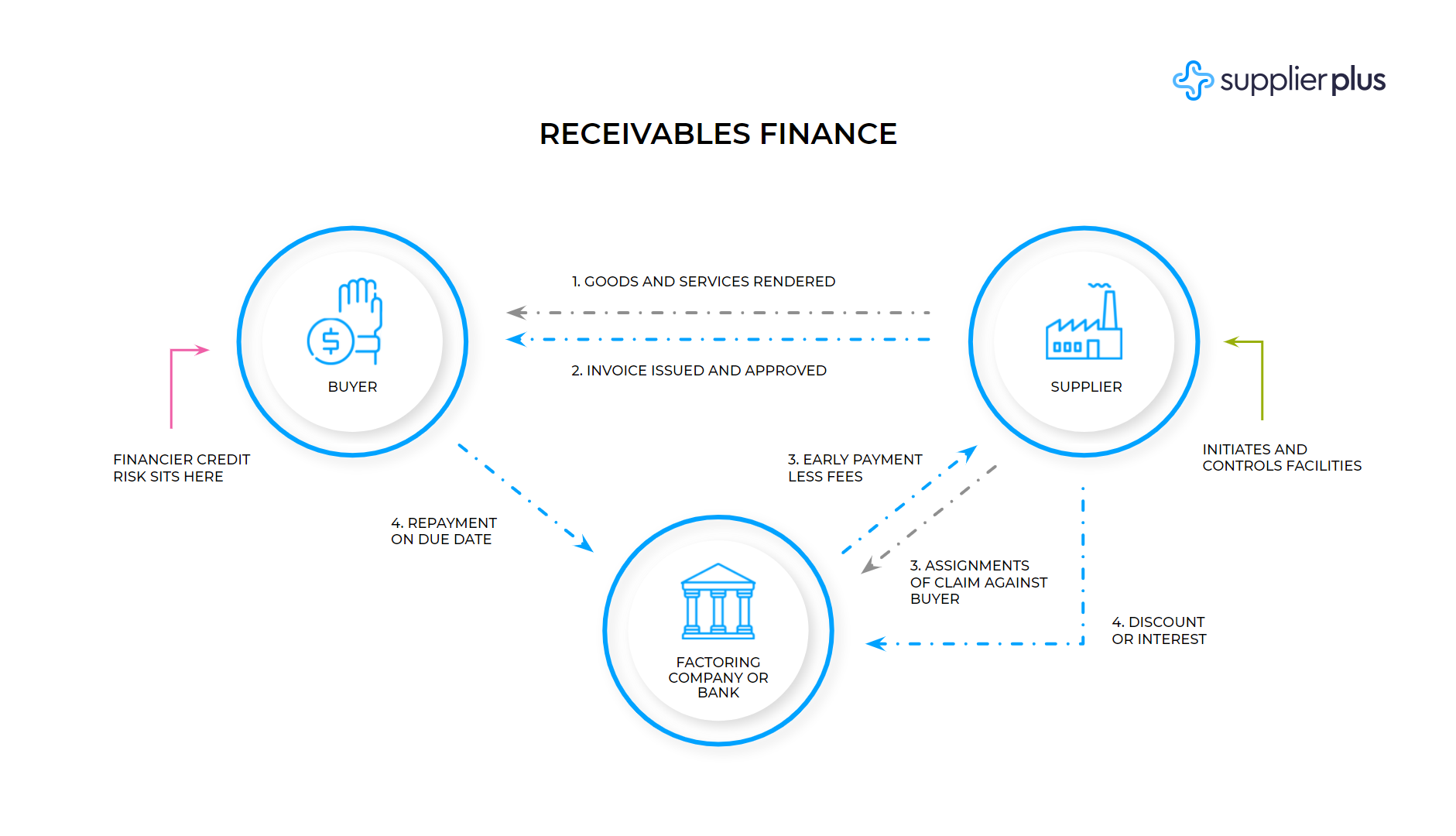

Receivables finance: a supplier sells the unpaid invoice to a financier, who pays the amount in full (minus the discount fee). The rights and obligations are assigned to the financier, which means that the financier assumes full credit risk as well as responsibility for collections. There is no recourse to the supplier should the payment default.

This technique is available to suppliers regardless of credit profile, while buyers need to have strong financials and exhibit reliable payment behaviour.